What is anti-money laundering (AML)?

Anti-money laundering (AML) refers to a set of laws, regulations, and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. AML efforts span globally, with many countries, including the UK, implementing stringent measures to combat this financial crime. These laws require financial institutions and other regulated entities to monitor their clients’ transactions, report large transactions, and maintain records for a specified period. The ultimate goal of AML regulations is to deter criminal activities like drug trafficking, terrorism financing, and tax evasion by making it harder for criminals to hide the origins of their money.

Who should take the AML course?

An Anti-money Laundering course is targeted at professionals within the financial sector, legal firms, real estate, and other businesses that are at risk of being used for money laundering. This includes bankers, accountants, lawyers, and real estate agents, among others. Employees at various levels, from front-line staff who deal directly with customers to senior management responsible for overseeing compliance frameworks, can benefit from AML training. The course equips individuals with the knowledge and skills needed to recognise and prevent money laundering activities, making it crucial for those in positions where they can detect and prevent financial crime.

Is the AML course mandatory in the UK?

In the UK, AML training is mandatory for individuals and businesses operating within sectors identified as high risk for money laundering. This includes financial services, legal professions, accountancy services, estate agents, and other sectors outlined by the Money Laundering Regulations (MLR). The level of training required can vary depending on the role and the risk exposure of the business. Regulatory bodies such as the Financial Conduct Authority (FCA) enforce these requirements, ensuring that relevant personnel are adequately trained to comply with AML legislation.

What topics does the AML course cover?

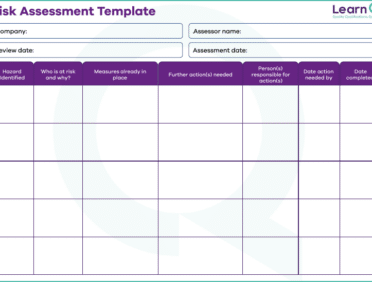

An AML course typically covers a wide range of topics essential for understanding and combating money laundering. These topics often include the basics of money laundering, stages of money laundering (placement, layering, integration), financing of terrorism, legal frameworks and compliance requirements, risk assessment and management, customer due diligence (CDD), record-keeping, and reporting obligations such as suspicious activity reports (SARs). Advanced courses may also delve into specific areas such as the use of technology in AML efforts, typologies of money laundering specific to certain industries, and case studies to illustrate practical challenges and solutions. The contents of the Learn Q Anti-Money Laundering Course are:

- Understanding of and commitment to The Proceeds of Crime Act 2002 and the Money Laundering, Terrorist Financing and Transfer of Funds Regulations 2017

- Red flags or suspicious activity that might suggest money laundering

- Preventing money laundering by understanding the steps in the process

How long does the AML course last?

The duration of an AML course can vary widely depending on the depth of content, mode of delivery, and the target audience’s existing knowledge and experience. Short introductory courses might last a few hours, providing a basic overview of AML principles. In contrast, comprehensive courses designed for professionals with specific roles in compliance, legal, or financial sectors may span several days to weeks. Online courses offer flexibility, allowing participants to complete modules at their own pace, while in-person training sessions may be structured over consecutive days for intensive learning. The Learn Q Anti-Money Laundering Course usually lasts 1-2 hours depending on the learner.

Is the AML course applicable to small businesses?

Yes, the AML course is applicable and often necessary for small businesses, especially if they operate within industries prone to money laundering risks, such as financial services, real estate, or legal advisory. Small businesses might not have the same volume of transactions as larger corporations, but they are still subject to AML regulations and can be exploited for money laundering purposes. AML training can help small business owners and their employees understand their legal obligations, recognise suspicious activities, and implement effective measures to mitigate risks, thus ensuring compliance with regulatory requirements.

Are there prerequisites for enrolling in the AML course?

Enrolment prerequisites for an AML course can vary based on the course’s complexity and intended audience. Basic AML courses, such as the Learn Q Anti-Money Laundering Course do not require any prerequisites, making them accessible to anyone interested in understanding anti-money laundering principles. However, more advanced courses aimed at professionals in specific fields, such as finance or law, may require participants to have a certain level of experience or knowledge in their respective areas. It’s always advisable to check with the course provider for specific enrolment criteria to ensure the course matches your educational and professional background.

How is the AML course assessed?

Assessment methods in an AML course can vary, but can typically include a combination of quizzes, exams, practical exercises, and case study analyses. These assessments are designed to test the participants’ understanding of AML principles, regulatory requirements, and their ability to apply this knowledge in real-world scenarios. For online courses, assessments might be conducted through multiple-choice questions or interactive scenarios, while in-person training could include group discussions and role-play exercises. Passing these assessments is often a requirement for certification, demonstrating the participant’s competence in AML practices. The Learn Q Anti-Money Laundering Course is assessed by way of a multiple choice quiz.

Can the AML course be customised for company-specific needs?

Many AML training providers offer the option to customise courses to meet specific company needs. This customisation can include focusing on the particular risks and challenges faced by the business, incorporating company policies and procedures into the training, and using relevant case studies from the company’s industry. Customised AML training can be particularly beneficial for organisations with unique business models or those operating in high-risk sectors, as it ensures that the training is directly applicable to the employees’ daily roles and responsibilities. Some companies like to start with an off-the-shelf course such as the Learn Q Anti-Money Laundering Course, then add some specific tailored information afterward. This allows them to keep costs down while still delivering specific content.

How does the AML course address international compliance standards?

AML courses often address international compliance standards by covering global AML frameworks and guidelines, such as those set by the Financial Action Task Force (FATF). These international standards provide a basis for national AML regulations, and understanding them is crucial for businesses that operate across borders. The course may discuss how these standards influence local laws and the implications for multinational corporations, ensuring that participants are aware of the requirements for international compliance and the need for harmonisation in AML practices across different jurisdictions.

Can the AML course be completed online?

Yes, the AML course can be completed online, offering flexibility and accessibility for participants. Online AML training has become increasingly popular, allowing individuals to learn at their own pace and schedule without the need for travel or physical attendance. These courses typically include a mix of video lectures, reading materials, interactive sessions, and assessments, providing a comprehensive learning experience. Online platforms also enable updates to course content to reflect the latest regulatory changes and emerging trends in money laundering and financial crime.

Are there case studies in the AML course?

Including case studies in an AML course is a common practice as they provide valuable insights into real-world scenarios, helping participants understand the complexities of identifying and combating money laundering. These case studies often explore specific instances of money laundering or financial crime, detailing the methods used by criminals, the challenges faced by financial institutions in detecting suspicious activities, and the steps taken to investigate and report these activities. Case studies enhance the learning experience by illustrating the practical application of AML principles and strategies.

How does the AML course address emerging technologies and digital transactions?

AML courses increasingly address emerging technologies and digital transactions, given their growing relevance in the financial sector. This includes topics such as cryptocurrency, blockchain technology, digital payment platforms, and the use of artificial intelligence and machine learning in monitoring transactions. The course explores the challenges and opportunities these technologies present for both money launderers and those tasked with preventing money laundering, highlighting the need for adaptive AML strategies that can evolve with technological advancements.

How much does it cost to get certified in anti-money laundering?

The cost of obtaining an AML certification can vary widely depending on the provider, the depth and length of the course, and the certification’s prestige. Basic online courses might be relatively inexpensive (the Learn Q Anti-Money Laundering Course costs just £17.50), while comprehensive training programs offered by reputed institutions or professional bodies may cost significantly more. It’s important to consider the value of the certification in terms of career advancement, compliance requirements, and the quality of the training when assessing the cost. Employers may also cover the cost of AML certification as part of professional development programs.

Is the AML course recognised by regulatory authorities?

AML courses offered by reputable training providers or professional bodies are often recognised by regulatory authorities, especially when they align with the standards and guidelines set by national and international AML regulatory bodies. Recognition can vary depending on the jurisdiction and the specific regulatory authority, so it’s advisable to choose courses that are widely acknowledged within the financial and legal sectors. This recognition ensures that the certification is valued by employers and meets compliance requirements for AML training. The Learn Q Anti-Money Laundering Course is CPD accredited. It meets accepted Continuing Professional Development (CPD) guidelines and is accepted for the majority of regulatory authorities.

Can the AML course be beneficial for career progression?

Completing an AML course and obtaining certification can significantly benefit career progression, especially for professionals in the financial, legal, and compliance sectors. AML expertise is highly valued due to the critical importance of compliance in these industries, and certification can demonstrate a professional’s commitment to maintaining high standards of practice. It can open up opportunities for advancement into senior compliance roles, specialist positions in financial crime prevention, and advisory roles in AML policy and regulation.

How frequently should AML training be undertaken?

The frequency of AML training should be guided by several factors, including regulatory requirements, changes in the AML landscape, and the specific risks faced by the organisation. Regulatory bodies often recommend that AML training be conducted at least annually, but more frequent training may be necessary in high-risk environments or when there are significant changes in legislation, financial products, or criminal methodologies. Continuous learning and regular updates are crucial for maintaining an effective AML compliance program.

How long does AML certification last?

The validity period of an AML certification can vary depending on the issuing body, but many certifications require renewal every few years to ensure that professionals stay up-to-date with the latest developments in AML regulations and practices. Renewal may involve completing continuing education credits, attending refresher courses, or passing a recertification exam. Staying current with AML certification not only demonstrates ongoing commitment to professional development but also ensures compliance with evolving regulatory standards.

How frequently should AML CFT training be provided?

AML CFT (Anti-Money Laundering and Counter-Financing of Terrorism) training should be provided regularly to ensure that employees remain aware of their compliance obligations and are equipped to identify and report suspicious activities. The frequency of training can depend on various factors, including the role of the employee, the level of risk associated with their position, and changes in the regulatory environment or criminal techniques. High-risk sectors and roles may require more frequent training, potentially annually or biannually, to address new threats and compliance requirements effectively.

How can I enrol in the AML course?

Enrolling in an AML course typically involves selecting a reputable provider that offers training aligned with your professional needs and regulatory requirements. Many providers allow you to register directly on their website, where you can choose the course that best fits your schedule and learning preferences, whether it’s online, in-person, or a blend of both. It’s important to review the course content, accreditation, and testimonials to ensure it meets your expectations. Once you’ve selected a course, the enrolment process usually involves completing a registration form and processing payment, after which you’ll receive access to the course materials and further instructions.

The process for the Learn Q Anti-Money Laundering Course is straightforward. The course is online so you when make a purchase we will create individual profiles for yourself and any colleagues and you will be sent the log in credentials by email.

You would simply use the credentials to log in and complete the course and knowledge review in your own time.

The certificate is downloadable from the portal where you complete the course and available as soon as you pass the knowledge review at the end of the course.

Anti-money Laundering Training

You can take the Learn Q Anti-Money Laundering Course for just £17.50 per person here: https://learnq.co.uk/courses/business-compliance/anti-money-laundering

For related courses, please see our business compliance course catalogue.